15 Statistics about Small Commercial Digital Strategy

What the surveys say....

15 statistics to take into consideration in your small commercial digital strategy.

If you are interested in reviewing the full studies, we have provided links to the studies at the bottom of this web page.

Small business owners have high trust in their agents. In fact, small business owners who buy insurance from agents rate them an average 4.26 on a 5-point scale.

-PIA IT Lab Small Business Owners Survey

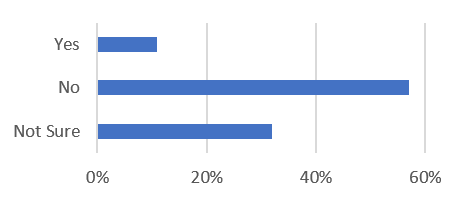

Overall, 57% of respondents said they would not switch, but 32% of businesses indicated they were not sure if they would consider switching for more online capabilities.

Would you consider switching agencies if another had more online service capabilities?

-PIA IT Lab Small Business Owners Survey

While customers are satisfied with agents’ ability to serve them online, this rating is not as high as others—leaving an opening for agents to pay attention to this area. Do you have a portal for clients for basic and routine requests? Are your clients aware? Is it easy to use? These are all questions agencies should be considering.

Small business owners rate their agencies’ ability to serve them online slightly above average (3.75 out of 5)

-PIA IT Lab Small Business Owners Survey

Small business owners report solid overall satisfaction rates when it comes to servicing their insurance coverage, but they don’t report the same level of satisfaction when it comes to their online experience, according to a study from The Hanover Group.

What do they want to do online? Overall, 78% reported viewing and paying bills online is of high importance. Requesting certificates of insurance and viewing and downloading policy documents are similarly important capabilities.

According to small business quoting solution Semsee, almost 60% of small business customers would consider switching agencies if another could provide quotes on new coverage options faster.

Would you consider switching agencies if another could provide quotes on new coverage options faster?

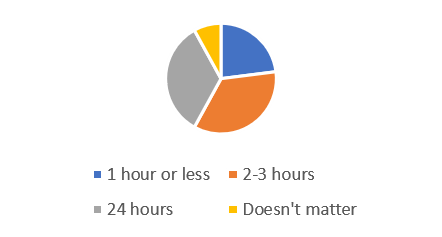

While customers want fast quotes they don’t expect them immediately. Overall, 77% of small business insurance shoppers said they’ll wait 2-3 hours or longer for new quotes.

When shopping for new insurance, how quickly do you expect your agent to provide quotes for new policies?

According to Semsee, more than 8 out of 10 small business owners say it’s important for their agents to provide quotes from multiple carriers and offer the ability to see and compare coverages and pricing. The two most important things small business customers want when working with insurance agents are fair prices and breadth of coverage options.

When shopping for new insurance, how important is it that your agents provide quotes from multiple carriers?

-Semsee Small Business Snapshot August 2020

When shopping for new insurance, how important is it that the process is transparent (i.e. you can see and compare quotes and services from multiple carriers)?

-Semsee Small Business Snapshot August 2020

In working with your insurance agent which is most important to you?

-PIA IT Lab Small Business Owners Survey

According to the research from PIA’s IT LAB, sharing clear price and coverage information online is the #1 way agents can increase trust. Additional ways to build trust include: improving the website, showing customer testimonials, being clear about commissions, and keeping up with changes in business, and proactively address at renewal time.

Are there things your agency could do to increase your level of trust?

Other suggestions included:

Other suggestions included:

- Walk through gotcha scenarios of insurance coverage

- Explain how rates are established

- Faster responses

- Fight for lower rates

- Keep up with the changes in business to proactively address at renewal time

- Be clear about commissions

-PIA IT Lab Small Business Owners Survey

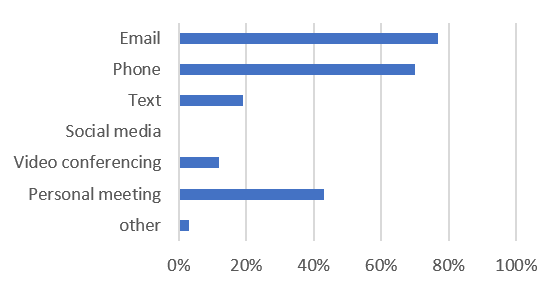

Agents need to meet their customers where they are when it comes to communication. While new methods such as video conferencing and texting are gaining popularity, small business owners still prefer for their agent to reach out via phone or email.

How do you want agents to communicate with you?

-PIA IT Lab Small Business Owners Survey

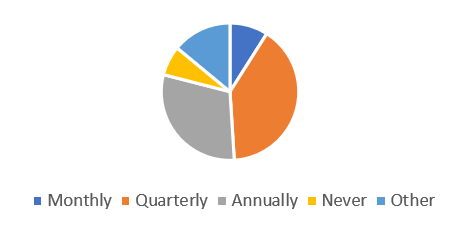

Small business customers also want to hear from their agents more frequently. Overall 40% want quarterly communications, while 30% are happy to hear from agents once a year.

How often do you want your agent to proactively reach out to you with news and information that can help you with your insurance needs?

-PIA IT Lab Small Business Owners Survey

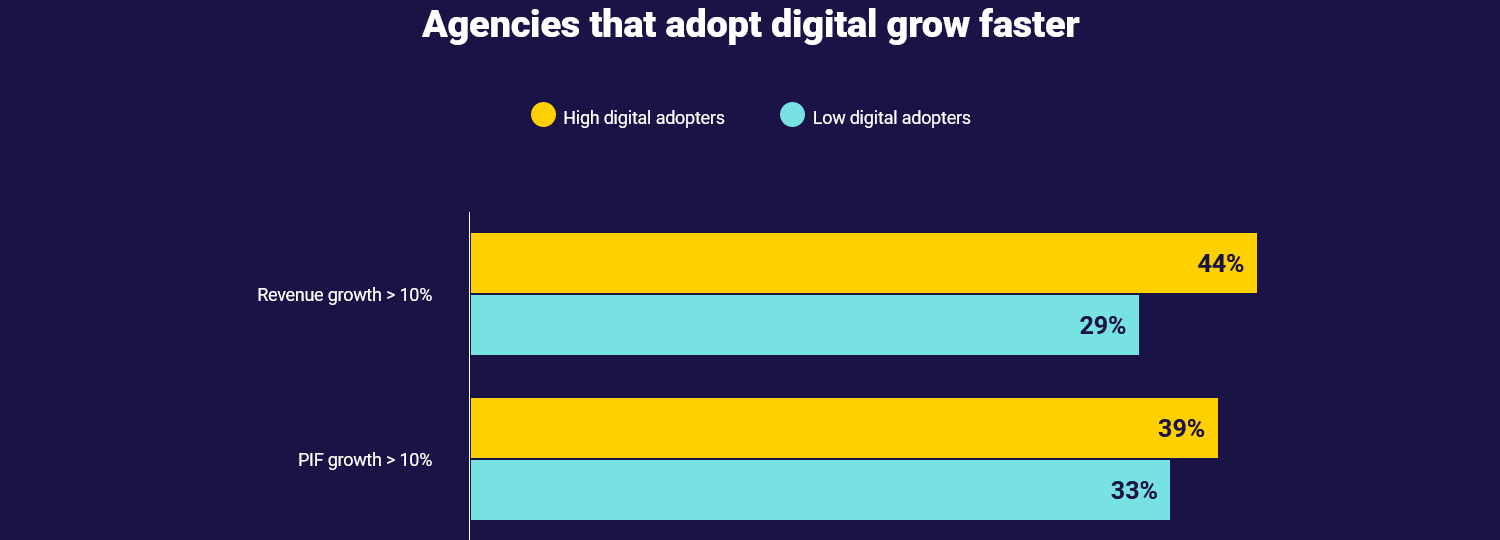

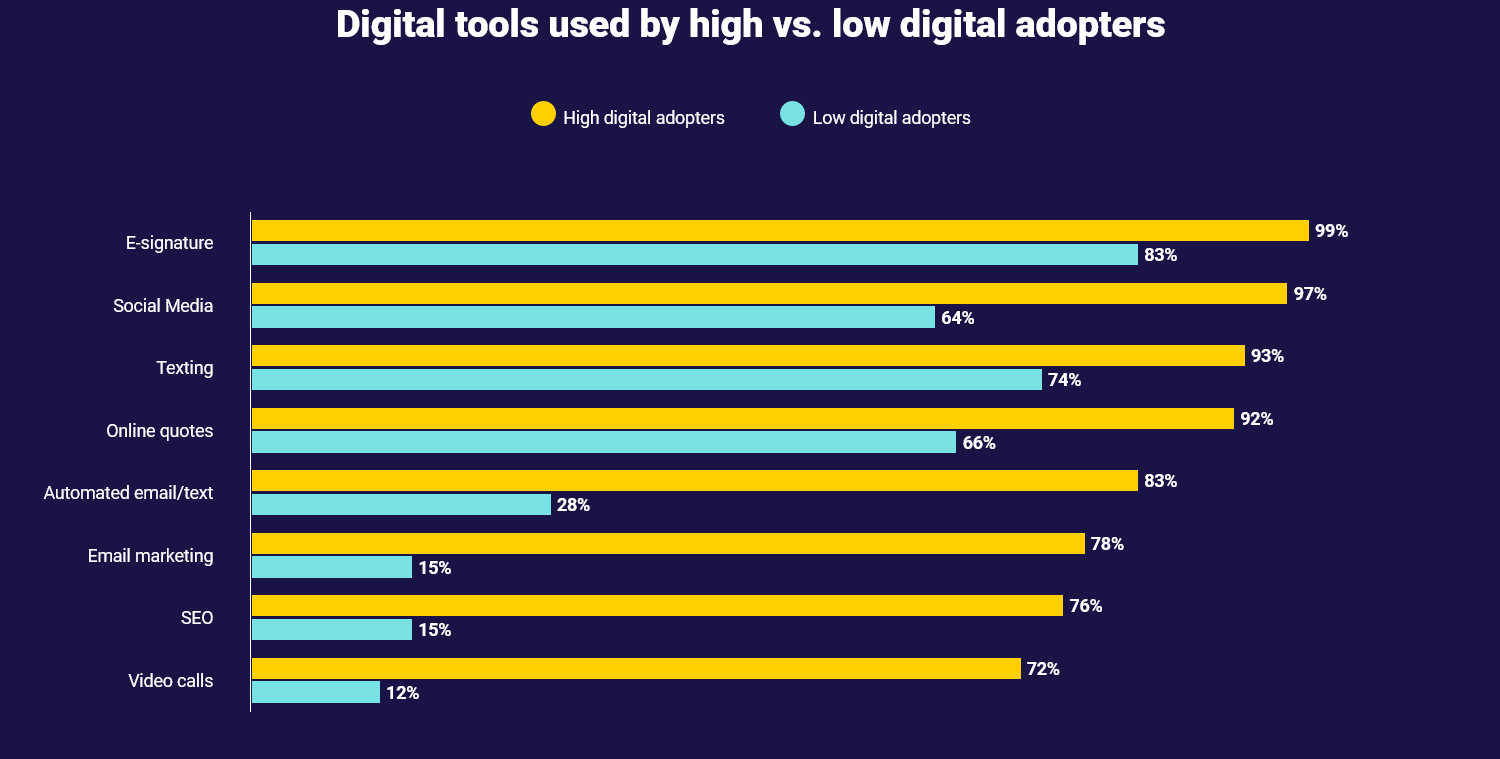

The numbers don’t lie – agencies that have more digital capabilities are more likely to be high growth agencies, according to a recent study from Liberty Mutual and Safeco. Digital capabilities that tend to lead to more growth include: online quotes, social media, self-service portal, live online chat, paid social media advertising, video quotes and policy reviews, chatbots and AI.

Digital marketing is growing among all agencies. More than half of all agents are prioritizing digital marketing.

-Liberty Mutual and Safeco’s Rise of the Digital Insurance Agency

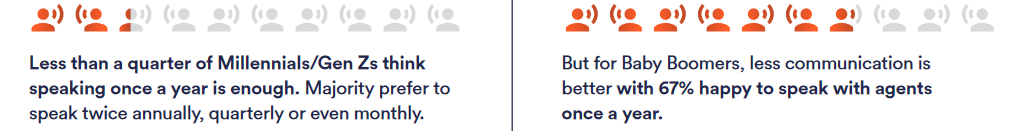

Millennials and Gen Zs make up a growing number of small business owners. And they want more – more options, more communication, and more service. They are looking for agents to be trusted advisors who can guide them through the insurance experience.

There’s a real need for educating small business customers about what’s in their policies.

Millennials and Gen Zs want more choice than Baby Boomers—they want to see more coverage and pricing options, more often. Millennials and Gen Zs are digital natives, very comfortable with searching for and getting answers using technology—their expectations for insurance are no different.

Younger business owners want more regular communication and interaction with their agents than Baby Boomers. They are used to more high-touch service (even if it’s online) based on many of the brands they interact with regularly.

PIA IT Lab Small Business Owners Survey

A survey of over 100 small business owners, conducted between January – March 2021 measuring their level of trust with their current insurance agencies and satisfaction with the agents’ online capabilities.

The Hanover Group’s 2020 Small Business Risk Report

Developed in partnership with Forbes Insights, this report reveals the major themes, sentiments and feedback of small business owners as it relates to their insurance protection, exploring:

- Changing risk landscape—growing areas of concern for small business owners

- Influence of rate-- how rate changes drive more interest from small business owners in their coverage options

- Digital servicing – small business owners digital preferences and the value of online servicing

Semsee’s Small Business Snapshot

Semsee, the small business quoting solution for agents, created the Small Business Snapshot to be a survey series giving agents insights into small business insurance buyers.

The Small Business Snapshot August 2020 explored how agents can use technology to better serve their customers needs.

The Small Business Snapshot January 2021 identified the differences between how Millennials/Gen Z small business customers and Baby Boomers want to interact with agents.

Liberty Mutual and Safeco’s Rise of the Digital Insurance Agency

This report examines the business value of digital and distills key trends into actionable insights to help independent agents and brokers navigate the rising tides of digital. The study wasn’t specific to small commercial. It surveyed independent agencies who sell personal lines, small commercial or a combination of both, but the findings have implications for those looking to increase sales in the small commercial space.