Industry News

401(k) Catch-Up Contributions- How You Can Save More For Retirement

Whether you currently have a 401(k), or you are looking to start one for your business, it is important to know the rules and regulations of the plan. One piece of information you will want to stay up to date on is the annual deferral limits, as they are subject to adjustments each year. This limit determines how much an employee is able to contribute, and how much they can receive from the company.

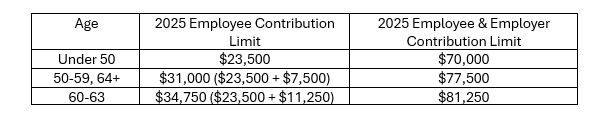

For 2025, employees under the age of 50 are able to contribute up to $23,500 into a 401(k) on an annual basis. This is an increase from the limit of $23,000 in 2024. This limit only relates to the contributions an employee makes into the 401(k). Including what the employer is allowed to contribute to an employee’s account through a match and/or profit sharing, that brings the total annual limit to $70,000.

The IRS has also implemented rules that allow employees who are nearing retirement to save more through what’s called a “Catch-Up Contribution”. This catch-up contribution allows employees above the age of 50 to contribute an additional $7,500 to a 401(k). Beginning in 2025, employees aged 60-63 now have access to an “Enhanced Catch-Up Contribution”, further increasing the amount that they are able to save each year. The enhanced catch up contribution is 150% of the traditional catch up, which comes out to $11,250. This brings the amount an employee is able to contribute up to $34,750 annually. The table below shows the different contribution limits at different ages.

A 401(k) is a good tool when it comes to saving for retirement for both business owners and employees. As the business owner, you have the ability to determine how much to contribute from your own pay and from the company’s side. By maximizing these contributions, you not only strengthen your retirement savings but also enjoy potential tax advantages, helping to lower your business’s overall tax burden. This strategy demonstrates long-term financial planning and a commitment to both your personal and employees' futures. Please reach out to us if you would like to discuss a plan you currently have in place, or if you would like to join the PIA’s 401(k) program to offer a plan for the first time.

DiMatteo Group Financial Services

203-924-5420

1000 Bridgeport Ave, Suite 506, Shelton, CT 06484

https://www.dimatteofinancial.com/

Leave a comment